2024-2025 Fiji National Budget Highlights

Budget HighlightsBy Atnesh Prasad, Tax Director

The Honourable Professor Biman Prasad, Deputy Prime Minister for Finance, Strategic Planning, National Development & Statistics, announced Fiji’s 2024-2025 National Budget on the morning of June 28, 2024.

The 2024-2025 budget represents a shift towards transparency, addressing previous criticisms and responding accordingly.

While continuing several incentives and initiatives from previous years, the budget introduces new measures based on past data and economic forecasts.

More details of the 2024-2025 Fiji National Budget are highlighted below:

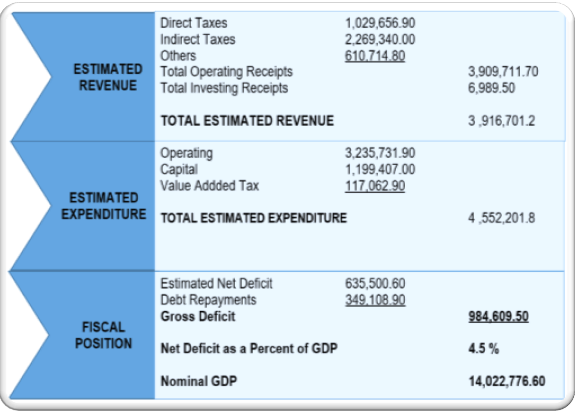

Fiji Budget Estimates

2024-2025

Tax Measures

|

Income Tax |

|||||||||||

|

1. Advance Tax Payment Rules |

|

||||||||||

|

2. Accelerated Allowance for Depreciation on Buildings |

|

||||||||||

|

3. Depreciation Schedule

|

|

||||||||||

|

4. Transfer of Benefits for Reorganization

|

|

||||||||||

|

5. Incentive for 2031 Pacific Games Bid |

|

||||||||||

|

6. National Rugby League (NRL) Bid Incentive |

|

||||||||||

|

7. Business Losses

|

|

||||||||||

|

8. Fringe Benefits Tax (FBT) – Value per Quarter for Motor Vehicles

|

|

||||||||||

|

9. Fringe Benefits Tax (FBT) – Value per Quarter for Electric Vehicles |

|

||||||||||

|

10. Exemptions for Non-profit Organizations

|

|

||||||||||

|

11. Clarity on the Incentive Applications

|

|

||||||||||

|

12. Project Definition Under the Tax-Free Region Incentive

|

|

||||||||||

|

13. TFR Incentive – Existing Indigenous Companies |

|

||||||||||

|

14. TFR Incentive

|

|

||||||||||

|

15. Information Communication Technology (ICT) Incentives |

|

||||||||||

|

16. Pandemic Reserve

|

|

||||||||||

|

17. Investment Allowance – Hotel Incentives

|

|

||||||||||

|

18. Short Life Investment Package (SLIP) – Existing Companies

|

|

||||||||||

|

19. Drug Rehabilitation Centre Incentive

|

|

||||||||||

|

20. Elimination of Double Taxation for Fiji Citizens Working Abroad |

|

||||||||||

|

21. Employment Taxation Scheme |

|

||||||||||

|

22. Sub-Division of Land Incentive |

|

||||||||||

|

23. Export Income Deduction |

|

||||||||||

|

Tax Administration Act (TAA) |

|

|

1. VAT Evasion Penalty |

|

|

2. Forfeited Refunds |

|

|

3. Offsetting of Refunds

|

|

|

4. Detained Non- Perishable Goods |

|

|

5. Bulk Data Collection |

|

|

Value Added Tax (VAT) Act |

|

|

1. Issuance of Tax Invoice for Transactions below $10 |

|

|

2. VAT Monitoring System (VMS)

|

|

|

3. VAT Return Filing |

|

|

Water Resource Tax Act |

|

|

1. Increase in the Water Resource Tax Rate |

|

General Matters

- Pay Rise for Civil Servants: Effective August 1, 2024, salary-based civil servants will receive a pay increase of 7% to 10%, while wage earners will see increments ranging from 10% to 20%.

- National Minimum Wage Rate: The national minimum wage will rise to $4.50 an hour starting August 1, 2024, with a further increase to $5.00 an hour from April 1, 2025.

- Vatukoula Strike Settlement

- The Coalition Government, in collaboration with the Fiji Trade Union Congress and Fiji Mine Workers Union, has resolved the long-standing strike with a $9.2 million pay-out.

- Each of the 368 striking mining workers will receive $25,000, with $10,000 disbursed from this budget and the remaining $15,000 from the 2025-2026 budget.

- FNPF Pension Restored:

- This applies to pensioners who opted to continue with a full pension at reduced rates, excluding those who partially or fully withdrew their funds.

- The government will cover the reinstatement cost, allocating $4 million this year, with an estimated total cost of $57 million over the next two decades.

- Effective August 1, 2024, all affected FNPF pensioners will have their pensions restored.

- Back to School Support: A $40 million allocation provides $200 in support per child from families with a household income of less than $50,000.

- Termite Relief Packages: $2 million is allocated for homeowner relief packages, targeting repairs and reconstruction of termite-damaged houses.

- Health Sector Funding: A total of $540 million is allocated, with $450 million for the Ministry of Health and $90 million for the operations of Ba and Lautoka hospitals under a PPP arrangement.

- Tertiary Education Loan Scheme (TELS): $150.5 million is allocated to support 9,940 continuing students and 10,830 new students, with new schemes and enhancements to existing ones.

- Fiji Roads Authority: Provided $354.8 million for ongoing road construction and maintenance, bridge and jetty upgrades and rural road improvements.

- Water Authority of Fiji: $259.4 million is allocated to ensure consistent and efficient water and wastewater services for investors, businesses and homeowners.

- Ministry of Sugar Industry & Multi-Ethnic Affairs: Receives increased funding of $76.1 million.

- Ministry of Agriculture: An additional $6 million, totalling $101.2 million, to boost the agricultural economy.

- Ministries of Fisheries and Forestry: Allocated $25.3 million and $31.4 million, respectively.

- Ministry of Tourism and Civil Aviation: $68.8 million is allocated, including a $44 million grant for Tourism Fiji and $13.6 million for the Fiji Tourism Development Program in Vanua Levu.

- New Co-operative Grant: Up to $100,000 for registered co-operatives in 15 sectors to diversify business activities. The Ministry of Trade Co-operatives & Small Medium Enterprises receives a total budget of $106.6 million to fund film tax rebates, business investments, digital initiatives and trade enhancement programs.

Conclusion

The 2024-2025 Fiji National Budget demonstrates a significant move towards transparency and responsiveness to public concerns. By incorporating new measures alongside continued support for existing initiatives, the budget aims to foster economic growth, improve public services and enhance the welfare of Fiji's citizens. This strategic allocation of resources is expected to address critical areas such as health, education, infrastructure and social welfare, setting a solid foundation for sustainable national development.